Not known Facts About Short Term Loan

Table of ContentsThe Buzz on Short Term LoanSome Of Short Term LoanWhat Does Short Term Loan Do?Fascination About Short Term Loan

The Workplace of Student Financial assistance has funds available for short-term finances to help students with temporary capital problems. Short-term car loans are offered only to trainees who are presently going to the university (lendings can not be refined between quarters) - Short term loan. Students that are auditing courses or those enrolled yet not gaining credit ratings are not qualified for temporary finances.If you have any type of concerns, feel cost-free to speak with a therapist in the Workplace of Student Financial Aid, 105 Schmitz Hall, or call 206-543-6101. University of Washington pupils might have the ability to borrow a temporary car loan for tuition, books, or other expenses if they: Are signed up in regular credit-earning classes in the UW Pupil Database Do not have an exceptional temporary car loan Have a good repayment document on any kind of previous temporary finance(s) (no even more than two late repayments) Have a way of repayment by the following quarter Any kind of previous temporary loans have to be paid completely before an additional funding can be obtained.

$2,500 for Undergraduates $3,200 for Graduate/Professional pupils There is no passion, but a service fee of $30 will be contributed to the payment amount for every financing. Late charges and collection costs will be examined if not paid by the due date. Car loan profits might be used straight to your tuition account, disbursed straight to you, or a combination of both.

Short Term Loan for Beginners

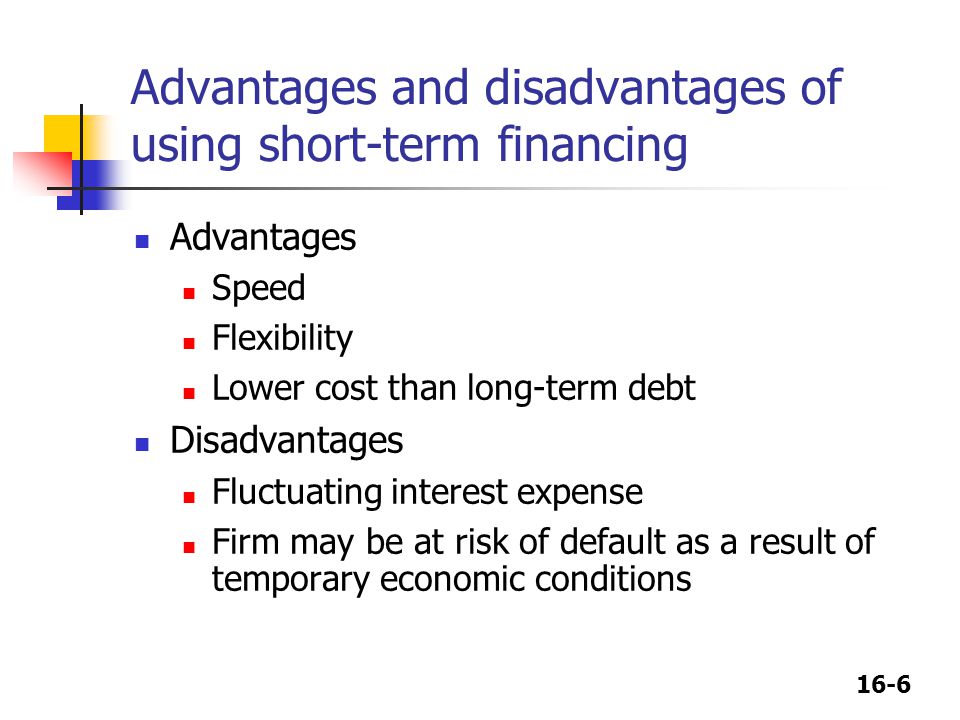

When it comes to business here are the findings financings, the size of your individual company financing term is practically as important as protecting funds. Mostly all companies require additional capital at some point, but there's a large difference in between long-lasting fundings and also momentary funding remedies, or else recognized as brief term financings. A lot of short-term bank loan are repaid within a year or much you can try these out less, but some lasting fundings can last over a decade.

Unlike long-term lendings, short-term lendings do not come with the danger of accumulating big debts or rate of interest and don't have the lasting commitment to finance payments. A brief term lending can supply the right amount of cash for your business while enabling you to repay the finance promptly.

Short Term Loan - Questions

Short-term car loans been available in convenient when you have an emergency situation yet remain in a financial fix. It is, however, necessary to have the appropriate details concerning this kind of loan before participating in an economic commitment. This blog site aids you obtain this crucial details regarding short-term fundings. A lot of, if not all, loan providers in South Africa offer short-term loans.

They frequently come at an adaptable repayment period and cost effective rates. A Short-term is an un-collateral credit history typically paid in a year or less. Some economic intents have these financings paid off in weeks or months. You can use this lending for individual or company purposes. look these up As a result of their non-collateralized nature, short-term loans typically draw in greater rate of interest prices as well as frequently have various other charges.

Most monetary institutions in South Africa enable you conveniently apply for this financing online. You only require to provide the loan providers with an Evidence of income, ID as well as various other necessary debt information. It's important to review the conditions, rate of interest, payment timetable, and other financing details prior to sending your application.

Failing to pay off in time might cause an adverse credit history. Temporary loans are frequently due in weeks or months. Like any other financial, bare minimums must be fulfilled for you to get approved for a temporary financing. Below are the called for papers South African loan providers request when allying for fundings under this classification: A copy of the National ID Evidence on revenue Evidence of residences They are various kinds of temporary fundings in South Africa.

More About Short Term Loan

This enables the lender to deduct settlements from the consumer's account. Borrow transparently with Adaptable Finances. Obtain transparently with Versatile Fundings. On the internet loans suit this classification of credit score. Lenders deal on the internet loans that permit you to promptly borrow money for emergency situations or any various other experience without meeting any person. This lowers the documents during loan applications.

On the internet fundings attract high-interest prices with brief payment durations. Bank over-limits are another type of temporary. Account overdraft accounts allow customers to butts cash money also when their account equilibrium is no. The principal quantity plus rates of interest is guided immediately to your account money to cover your negative account balance. Small monetary company normally supply cash finances in South Africa.

Cash money finances enable you to rapidly arrange out other economic responsibilities also when you are on low cash. Right here are some advantages of obtaining a temporary finance: Short-term lendings are quickly obtainable to tiny organizations and individual consumers.

Comments on “Rumored Buzz on Short Term Loan”